You Need More Insurance on Your Motorcycle!

You have $100,000.00 of liability coverage, uninsured motorist coverage, underinsured motorist coverage and PIP coverage on your automobile, but on your motorcycle you have no PIP coverage, uninsured motorist or underinsured motorist coverages. As a Louisville motorcycle lawyer, I have observed that this type of coverage disparity between automobile and motorcycle insurance is common, but the opposite of what it should be. our odds of significant injury are much higher in a motorcycle accident, where you have little if any protection in the event of an accident. The coverages for PIP (medical bills and lost wages), uninsured motorist (pain and suffering coverage when at fault driver has no insurance) and underinsured motorist coverage (pain and suffering coverage when at fault driver does not have enough insurance) are critical for any auto accident injury claim

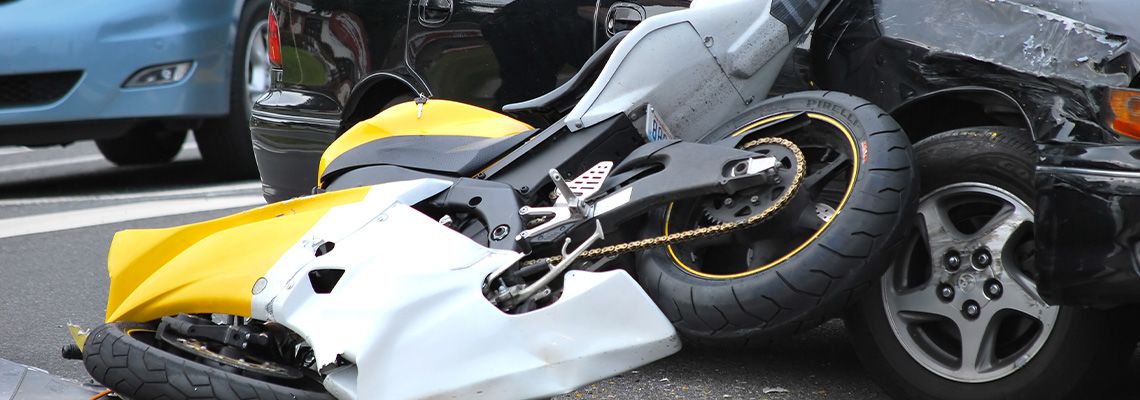

Do you think more insurance is needed in a car accident or motorcycle accident?

How did you answer the above question? If you understand that a motorcyclist has little or no protection from injury in the event of an accident, I hope you answered that more insurance is needed in the event of a motorcycle accident.

I am not positive why people, who can afford significant coverages on their automobile, fail to purchase similar coverages on their motorcycle. I suppose the main reason is to save money. The problem with this thought is that many of the coverages they are not buying are cheap. One such coverage is underinsured motorist coverage. This coverage is one of the most needed and used in auto accident claims because at fault drivers tend to have minimum limits of liability coverage. Underinsured motorist insurance allows you to buy protection against being injured by drivers who do not have enough insurance to satisfy your claim. Another reason people do not buy enough insurance on their motorcycle is because insurance agents fail to properly educate them on the coverages.

The last two motorcycle accident cases in my office involved medical expenses in excess of $200,000.00. Both clients had no PIP coverage, no uninsured motorist coverage and no underinsured motorist coverage. The at fault driver in one of the cases had $25,000.00 of liability insurance (the minimum limits required by Kentucky law and most common limits in Kentucky) and, therefore, this client will only receive a fraction of the value of their claim. The other case was lucky that the at fault driver had significant limits and he will receive a full value settlement.

Kentucky law requires PIP coverage on all automobiles, but not motorcycles. The lack of PIP coverages can cause the motorcycle accident victim financial hardship on a couple different levels. First, PIP coverage offers a partial lost wage benefit of $200/week and this can be valuable to someone unable to work due to their injuries. Of course, motorcycle accidents involve significant physical injuries and it is likely that the motorcycle accident victim will be off work due to their injuries. Secondly, the existence of PIP coverage extends the statute of limitations for their personal injury claims. If the motorcycle accident victim fails to settle their claim or file a lawsuit within one-year from the date of the accident, they will lose their claim entirely against the at fault party. If they had PIP coverage, they would have at least 2 years to resolve their claim or file a lawsuit.

When buying motorcycle insurance make sure that you purchase significant amounts of uninsured motorist, underinsured motorist and PIP coverages. One of the coverages that you may be able to reduce is liability coverage if you do not plan on having passengers on your motorcycle. A motorcycle does not often cause significant damages or injuries to others and, therefore, significant liability limits may not be needed. Of course, if you take passengers on your motorcycle, then significant liability limits would be necessary because motorcycle passengers can experience significant injuries.

Contact Louisville Motorcycle Accident Lawyer

If you need legal assistance due to a motorcycle accident, contact Louisville motorcycle accident attorney Matthew Troutman directly at 859-696-0001 or 502-648-9507 and he will meet with you in the hospital, your home or wherever is convenient for you. He will give you direct access through his cell phone and guide you through the difficult process necessary to obtain the best result possible for you in your car accident claim. To learn more about the Troutman Law Office, click here.